FINANCING

Competitive Laser Machine Financing

Control Laser Corporation has established a leasing program that will get your production line started in no time.

Customer financing is provided through CLC Financial Services program relationships with top Bank and Independent Lenders & Lessors. Our financing alliances are industry and equipment experienced and provide a competitive range of Finance or Capital leases, Operating leases, Loans and Term Rentals with Terms 36 to 84 months.

Advantages of Leasing

Stay Up-to-date

With a lease, you are able to upgrade to the latest technology after the lease expires. Easily compete with competitors with the latest.

Affordable Payments

No large up front costs for small and large businesses. Leasing laser equipment has never been easier!

100% Tax Deductable

The IRS Tax Code allows a corporation to deduct the full purchase price for equipment purchased or financed in the current tax year.

Preserve Business Credit

Equipment Leasing is an Alternative Source of Funds that lets you keep your business credit line open and strengthen the cash flow of your business.

Banking Partnerships with Competitive Rates

Some of our funding relationships are US Bancorp, Wells Fargo, Peoples Capital, Vision Capital, Kingswood Leasing, M-2 Leasing, Omni Leasing and others.

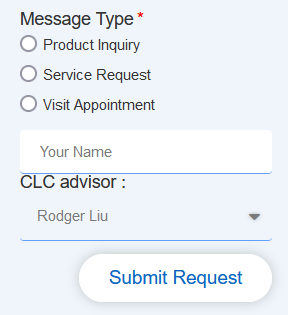

Application Submissions

Application and Credit review for up to $350,000 in equipment cost is with “Application Only”. Simply complete the attached CLC Financial Services application and submit using email or fax. Upon completion of a credit determination which is usually within one day, a term sheet with the approval terms and alternative finance options will be provided for your review prior to documentation for your equipment funding.

Non-Application Only Requests

For other, non application only requests simply complete the attached CLC Financial Services application and submit. We will contact you to discuss the additional needed financial information to process a standard credit review for your financing.